The Top 10 Reasons Finance Leaders Select TravelBank

No matter the size of your organization, an all-in-one expense and travel solution can help streamline expenses, improve visibility, and align budgets with your business goals.

1. Better Value for Money

TravelBank is less expensive than competitors’ pricing while offering more robust features through an all-in-one solution that combines expense tracking and corporate travel management seamlessly on one platform.

2. Insights for Finance Departments

Improve visibility into business spend with easy expense capture, an automated approval flow, and timely insights. TravelBank helps your team expedite reconciliation tasks, enables enhanced control, and gives you access to reporting for greater visibility into budget and financial forecasting.

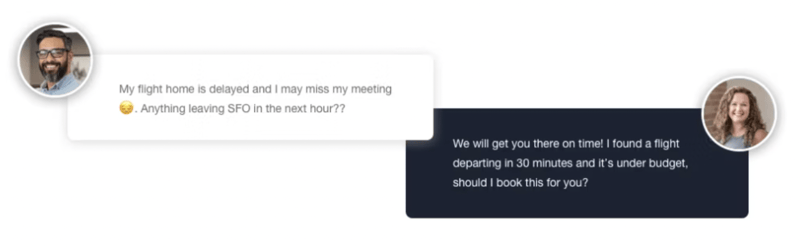

3. 24/7 Support

TravelBank boasts 97% CSAT scores, along with customer success teams that support each customer. Whether you’re on the road, or in the office, our team is standing by, in-app and over the phone, at no additional cost.

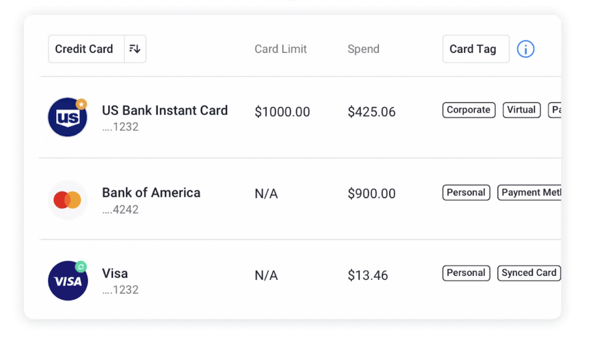

4. Corporate Card Flexibility

TravelBank supports and imports transactions from over 48,000 personal and corporate cards and banks allowing your team to manage and track your cards in one place. Issue virtual cards directly in TravelBank to extend purchasing power to employees and provide a safe, secure way to make contactless payments.

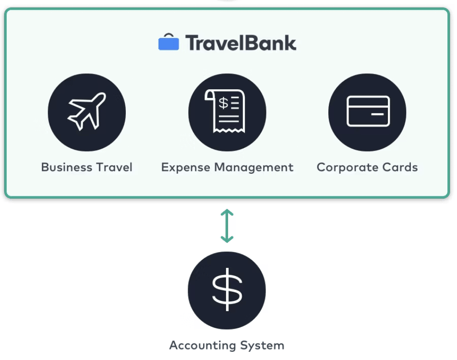

5. Seamless Integrations

Map expense categories and synchronize expense reports, reimbursements, and corporate card data between your current accounting products and TravelBank.

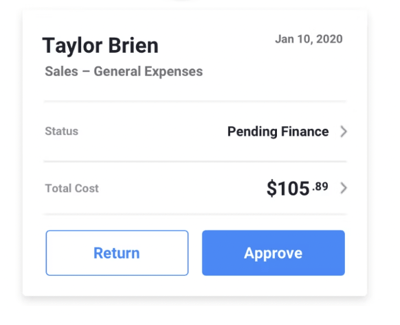

6. Faster Processing

Approve expense reports with one tap and reimburse employees in as little as 24 hours via direct deposit using TravelBank.

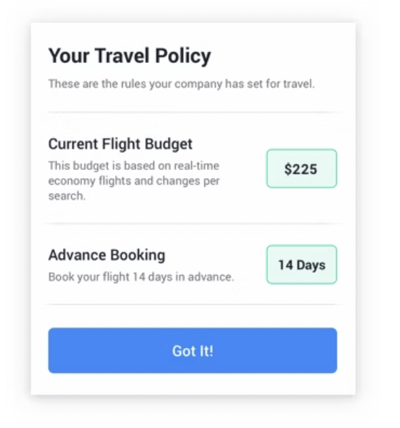

7. Travel Policy Compliance

As your travel program takes off, we can help ensure adherence to policies that encompass pre-trip approvals and the reimbursement processes for items such as meal expense parameters, flight bookings, hotel reservations, ground transportation, and more.

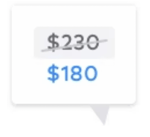

8. Leverage Negotiated Rates

Access over one million hotel properties. More than half provide discounts over 10% for TravelBank customers.

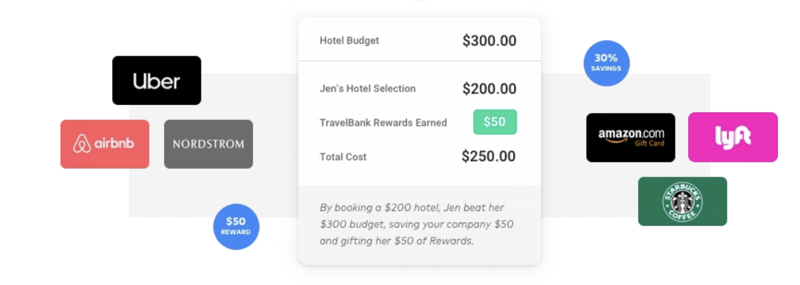

9. Rewards as Perks

Save up to 30% when you bundle expenses, travel, and rewards. Employees are incentivized to spend wisely when you offer them a portion of their savings as rewards for personal use. Points are redeemable in the TravelBank rewards store toward Uber, Lyft, Amazon gift cards, Airbnb, and more.

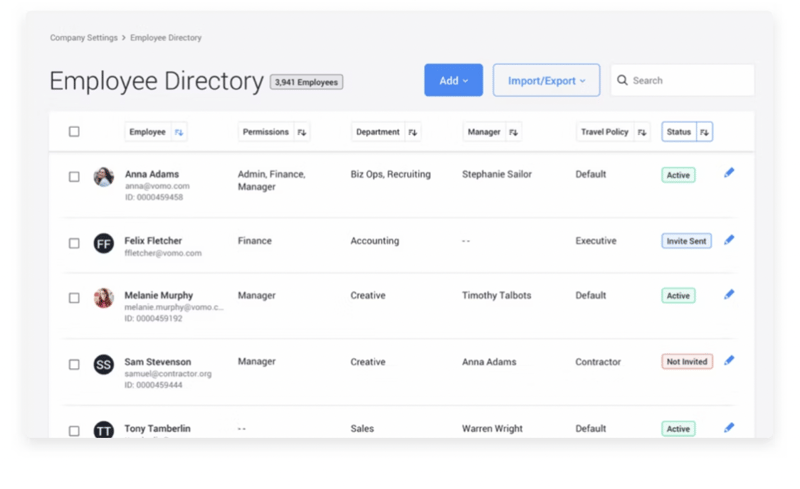

10. Highly Scalable

TravelBank can easily scale as your organization grows. For admins, company setup and employee management is a breeze. Your employee directory can be synced with your HRIS and displays each employee’s role and permissions in TravelBank.